Portflio

*****************************************************************

Writing Samples

ECONOMIC DEVELOPMENT IN THE AI ERA: HOW MIDSIZE CITIES CAN COMPETE

By Patricia Baronowski-Schneider

For Site Selection Magazine

In the race to attract technology companies driving the artificial intelligence revolution, midsize cities are often overshadowed by established tech hubs like Silicon Valley, Boston, and Austin. The conventional wisdom suggests that AI-focused companies will cluster exclusively in these innovation hotspots, leaving smaller communities behind in the emerging economy.

This narrative, however, is being challenged by a new wave of economic development strategies that are allowing midsize cities to successfully compete for AI investment. By leveraging their unique advantages and implementing targeted initiatives, these communities are proving that the AI economy need not be concentrated in just a handful of coastal metropolises.

The AI Talent Equation is Changing

The historic concentration of tech companies in major hubs was driven primarily by the clustering of specialized talent. However, the widespread adoption of remote work has fundamentally altered this dynamic. AI talent is now more geographically distributed than ever before, with many professionals prioritizing quality of life over proximity to traditional tech centers.

“We’re seeing a significant shift in location preferences among AI specialists,” explains Dr. Melissa Richardson, Chief Economist at the Economic Innovation Institute. “Five years ago, 72% of AI professionals were concentrated in just five metro areas. Today, that figure has dropped to 54% and continues to decline.”

This dispersal creates an opening for midsize cities that can offer the right mix of amenities, affordability, and technical infrastructure. Communities like Chattanooga, Tennessee and Des Moines, Iowa are capitalizing on this trend by creating “connected innovation districts” that combine gigabit internet infrastructure with mixed-use developments designed to foster collaboration while maintaining the quality of life advantages that distinguish these cities from larger metros.

Specialization Trumps Scale

Rather than attempting to compete with established tech hubs across the entire AI spectrum, successful midsize cities are focusing on specific AI verticals where they have existing strengths.

Consider Springfield, Illinois, which leveraged its position as a regional healthcare hub to develop an AI-healthcare innovation corridor. By focusing exclusively on healthcare AI applications, Springfield attracted three AI startups and a research center from a major tech company, generating 350 high-paying jobs in just 18 months.

“We knew we couldn’t compete with Chicago or the coasts for general AI development,” says Springfield Mayor Elizabeth Torres. “But in healthcare AI, our regional medical centers and existing healthcare workforce gave us a competitive advantage that even larger cities couldn’t match.”

This strategy of targeted specialization is proving more effective than general AI development incentives. According to research from the National Economic Development Association, midsize cities that focus on sector-specific AI initiatives are 3.5 times more likely to successfully attract investment than those pursuing generalized AI strategies.

Education Partnerships as Economic Development

The most successful midsize cities are reimagining the relationship between higher education and economic development, creating custom-designed academic programs that directly feed the AI talent pipeline.

Akron, Ohio partnered with the University of Akron to develop a specialized master’s program in polymer-focused machine learning – directly aligned with the region’s historical strengths in advanced materials. The program includes guaranteed internships with local employers and subsidized housing for students who remain in the region after graduation.

“Traditional economic incentives like tax abatements and infrastructure grants remain important, but talent development has become the primary currency of AI-focused economic development,” explains Robert Johnson, Director of Business Attraction for Akron’s economic development corporation. “Our university partnership has been more effective at attracting AI companies than any financial incentive we could offer.”

Infrastructure for the AI Age

Physical infrastructure requirements are evolving for AI-focused companies, creating opportunities for midsize cities to differentiate themselves. While digital connectivity remains essential, reliable and preferably renewable energy has emerged as a critical factor, given the enormous power requirements of machine learning operations.

Midsize cities in regions with abundant hydroelectric, wind, or solar capacity are leveraging these resources to attract power-intensive AI operations. Missoula, Montana recently secured a 225-job AI research center largely due to its access to low-cost, reliable hydroelectric power – outcompeting larger cities that couldn’t match its energy profile.

Water resources are similarly becoming a competitive advantage, as AI server farms require substantial cooling capacity. Communities with abundant water resources and advanced water management systems are finding this to be an increasingly valuable asset in attracting AI-related investment.

The Path Forward

For economic development professionals in midsize cities, competing in the AI economy requires a fundamentally different approach than traditional business attraction. Success comes not from mimicking the strategies of larger tech hubs, but from identifying and leveraging distinctive local advantages.

The communities seeing the greatest success are implementing four key strategies:

- Precision Targeting: Focusing on specific AI verticals aligned with existing regional strengths rather than pursuing AI companies indiscriminately.

- Talent Ecosystem Development: Creating customized academic programs and workforce initiatives that directly address the specific needs of target AI sectors.

- Quality of Life Emphasis: Leveraging and enhancing the authentic quality of life advantages that midsize cities offer compared to larger, more congested tech hubs.

- Resource Advantage Identification: Developing value propositions around unique local resources, particularly energy and water assets that support AI operations.

The AI revolution need not reinforce existing patterns of geographic inequality. With thoughtful planning and strategic investment, midsize cities across America can capture their share of this economic transformation, creating more resilient, diverse economies in the process. Economic developers who recognize and act on these changing dynamics position their communities not just to participate in the AI economy, but to thrive within it.

Patricia Baronowski-Schneider is a Senior Public Relations Director with over 15 years of experience working with economic development organizations and technology companies. She specializes in strategic communications for communities seeking to drive innovation-based economic growth.

PITCH: SOUTHEAST MANUFACTURING RENAISSANCE – THE CAROLINA CORRIDOR

TO: Janet Miller, Business Editor

FROM: Patricia Baronowski-Schneider

DATE: March 1, 2025

RE: Exclusive feature opportunity on the Southeast’s manufacturing transformation

Hi Janet,

Following up on our conversation last month about emerging economic trends, I wanted to share an exclusive opportunity to examine what economic developers are calling “The Carolina Corridor” – a 250-mile manufacturing powerhouse stretching from Charlotte to Charleston that’s reshaping America’s industrial landscape.

THE STORY ANGLE:

While much media attention focuses on tech hubs and the knowledge economy, a manufacturing renaissance is quietly transforming the Southeast, with the Carolinas at the epicenter. This region has attracted over $18 billion in manufacturing investment in the last 36 months alone – more than any other region in the country.

WHY THIS MATTERS NOW:

- Reshoring Acceleration: Post-pandemic supply chain vulnerabilities have accelerated reshoring, with the Carolinas capturing 22% of all U.S. reshoring announcements since 2022.

- Green Manufacturing: The region has secured five major electric vehicle and battery manufacturing facilities in the past 18 months, representing a fundamental shift from traditional automotive manufacturing.

- Workforce Innovation: Revolutionary workforce development programs are creating pipelines from high schools directly to advanced manufacturing careers, addressing the skills gap that has hampered industrial growth elsewhere.

WHO YOU CAN SPEAK WITH:

- David Chen, CEO of Electra Battery Systems, whose $3.6 billion investment in South Carolina represents the largest manufacturing project in state history (confirmed availability for interview)

- Dr. Maria Jefferson, Director of the Advanced Manufacturing Institute at Clemson University, who can discuss the technological transformation reshaping traditional manufacturing

- James Williams, Economic Development Director for York County, SC, who has helped secure over $2 billion in manufacturing investment and can provide perspective on how smaller communities are competing for these projects

- Rebecca Thompson, Chief Workforce Officer for North Carolina, who implemented the state’s Manufacturing Careers Pathway program that has become a national model

VISUAL OPPORTUNITIES:

Tours of Electra Battery’s new facility can be arranged, showcasing advanced robotics and automation systems. We can also provide access to York County’s Manufacturing Innovation Campus where high school students train on the same equipment used in modern factories.

DATA POINTS:

- Manufacturing jobs in the Carolina Corridor pay an average of $86,400 annually, 34% higher than the regional median household income

- 78% of new manufacturing positions require technical training but not four-year degrees

- The region has added 47,000 manufacturing jobs since 2021, bucking national trends

- Foreign direct investment accounts for 62% of new manufacturing capital in the region

I’d be happy to arrange interviews, provide additional data, or customize this story to align with your editorial focus. Do you think this could work for a feature in your upcoming manufacturing innovation series?

Best regards,

Patricia Baronowski-Schneider

Senior Public Relations Director

Pristine Advisers

516.473.4052 pbaronowski@hotmail.com

1. Feature Article (Thought Leadership)

Title: Sustainable Finance: How Regional Banks Are Driving the ESG Movement

In the world of finance, much of the attention on sustainability has focused on global investment giants and multinational asset managers. Yet, regional banks are quietly emerging as powerful drivers of the Environmental, Social, and Governance (ESG) movement.

By leveraging their close ties to communities, these banks are funding local renewable energy projects, expanding affordable housing, and pioneering green lending products that respond directly to regional needs. Unlike Wall Street, which often deploys capital at a global scale, regional banks are uniquely positioned to match ESG principles with place-based impact.

Take GreenState Bank in Iowa, for example. By introducing a “Green Loan” program for energy-efficient home improvements, they’ve not only financed thousands of retrofits but also reduced household energy costs for rural residents. Such initiatives prove that meaningful sustainability outcomes often start at the local level.

As regulators, investors, and consumers increasingly demand measurable ESG results, regional banks may soon become the unsung heroes of sustainable finance.

2. Media Pitch (Exclusive Angle)

To: Sarah Klein, Senior Business Reporter

From: Patricia Baronowski-Schneider

Date: March 10, 2025

Re: Exclusive feature on “The New Bioeconomy Belt”

Hi Sarah,

There’s a quiet revolution taking place across the Midwest — one that isn’t getting the headlines it deserves. Communities once reliant on traditional agriculture are transforming into biotechnology powerhouses, creating what local leaders are calling the Bioeconomy Belt.

The story angle: In just the past two years, this region has attracted over $9 billion in biotech and bio-manufacturing investments, driven by advances in agricultural tech, renewable fuels, and synthetic biology.

Why it matters now:

- The U.S. Department of Energy recently identified bio-manufacturing as a strategic priority for reducing dependence on foreign supply chains.

- New federal incentives are accelerating private-sector investment.

- Communities like Ames, Iowa, and Champaign-Urbana, Illinois, are positioning themselves as global bio-innovation hubs.

Potential voices for your piece:

- Dr. Anita Patel, CEO of Midwest BioWorks, who recently announced a $1.2 billion expansion.

- State Senator Lucas Freeman, architect of the Midwest Bioeconomy Act.

- Farmers-turned-biotech entrepreneurs leveraging new technologies to diversify income streams.

Would you be open to exploring this as an exclusive feature for your innovation series?

Best,

Patricia

3. Press Release (Corporate Expansion)

FOR IMMEDIATE RELEASE

NextGen Robotics Launches $40 Million Headquarters in Atlanta, Creating 300 High-Tech Jobs

ATLANTA, GA – March 12, 2025 – NextGen Robotics, a leader in autonomous systems and advanced manufacturing, today announced the opening of its new $40 million global headquarters in Atlanta. The facility is expected to create 300 new jobs over the next four years, ranging from AI engineers to precision machinists.

“Atlanta offers the perfect ecosystem for our growth — world-class universities, a thriving tech community, and an unmatched logistics network,” said NextGen CEO Michael Allen. “This headquarters solidifies our commitment to developing technologies that redefine automation in the U.S. and abroad.”

The expansion was supported by the Georgia Department of Economic Development and is part of a broader effort to position the state as a hub for robotics and advanced manufacturing.

Construction of the 100,000-square-foot facility was completed in just 14 months. The headquarters includes a robotics R&D center, a training academy for workforce development, and a demonstration floor showcasing live applications of industrial automation.

“Georgia is proud to welcome NextGen Robotics,” said Governor Emily Carter. “This investment underscores our state’s role in shaping the future of advanced manufacturing.”

For media inquiries:

Patricia Baronowski-Schneider, Director of Communications

pbaronowski@nextgenrobotics.com | (631) 756-2486

4. Op-Ed (Bylined Commentary)

Title: The Hidden Cost of Ignoring Proxy Defense in Closed-End Funds

While headlines often focus on activist victories in the corporate world, closed-end funds (CEFs) face a quieter but equally disruptive challenge. Activist investors have increasingly targeted these vehicles, pushing for liquidation, tender offers, or conversions that may undermine long-term shareholder value.

Too often, fund boards underestimate the speed and aggressiveness of these campaigns — only to find themselves reacting to activist pressure instead of proactively protecting investors. The reality is that a proxy fight, once initiated, is both costly and destabilizing. By contrast, investing in ongoing shareholder engagement, transparent communication, and strategic proxy defense can safeguard a fund’s independence at a fraction of the cost.

The lesson is clear: in today’s environment, CEFs cannot afford to view proxy defense as optional. They must treat it as a core element of fiduciary responsibility — one that ultimately protects not just the fund structure but the very investors they serve.

FOR IMMEDIATE RELEASE

INNOVATE MIDWEST ANNOUNCES $25 MILLION EXPANSION, CREATING 150 NEW TECH JOBS

COLUMBUS, Ohio – March 1, 2025 – InnovateOhio, the state’s premier technology innovation hub, today announced a $25 million expansion of its Columbus headquarters, a move expected to create 150 new high-paying jobs over the next three years.

The expansion, supported by a combination of private investment and state economic development incentives, will add 30,000 square feet of collaborative workspace designed to foster technological innovation and entrepreneurship in the region.

“This expansion represents our commitment to making Ohio a destination for tech talent and innovation,” said Jennifer Martinez, CEO of InnovateOhio. “By creating an environment where startups can thrive alongside established tech companies, we’re building a sustainable ecosystem that will drive economic growth for decades to come.”

The announcement comes as Ohio’s technology sector continues to grow at twice the national average, with the state attracting over $1.2 billion in venture capital investment last year. The expansion will focus specifically on supporting companies working in artificial intelligence, advanced manufacturing, and health technology – all identified as strategic growth areas in the state’s economic development plan.

“InnovateOhio has become a vital engine for job creation and economic growth,” said Governor Michael Reynolds. “This expansion will help us retain our homegrown tech talent while attracting new businesses looking for a vibrant, affordable alternative to coastal tech hubs.”

Construction is scheduled to begin in June 2025, with completion expected by early 2026. The new facility will include state-of-the-art research labs, flexible office space for startups, and a technology training center expected to serve 500 Ohio residents annually with upskilling programs.

The expansion will increase InnovateOhio’s capacity to house early-stage companies from 45 to 75, addressing the growing demand for space in the innovation hub, which currently has a waitlist of 30 startups seeking to join its ecosystem.

“This investment strengthens Columbus’s position as the Midwest’s fastest-growing tech hub,” said Columbus Mayor Regina Williams. “The ripple effects will extend beyond these 150 direct jobs, creating opportunities throughout our community and demonstrating that innovation can thrive between the coasts.”

The Ohio Department of Development estimates the expansion will generate an additional $18 million in annual economic impact for the region through indirect job creation and increased business activity.

About InnovateOhio

Founded in 2018, InnovateOhio is a public-private partnership dedicated to accelerating technology innovation and entrepreneurship across Ohio. The hub has supported over 200 startups that have collectively raised more than $300 million in venture funding and created 1,200 jobs in the state. For more information, visit www.innovateohio.org.

Media Contact:

Sarah Thompson

Director of Communications, InnovateOhio

sthompson@innovateohio.org

(614) 555-0123

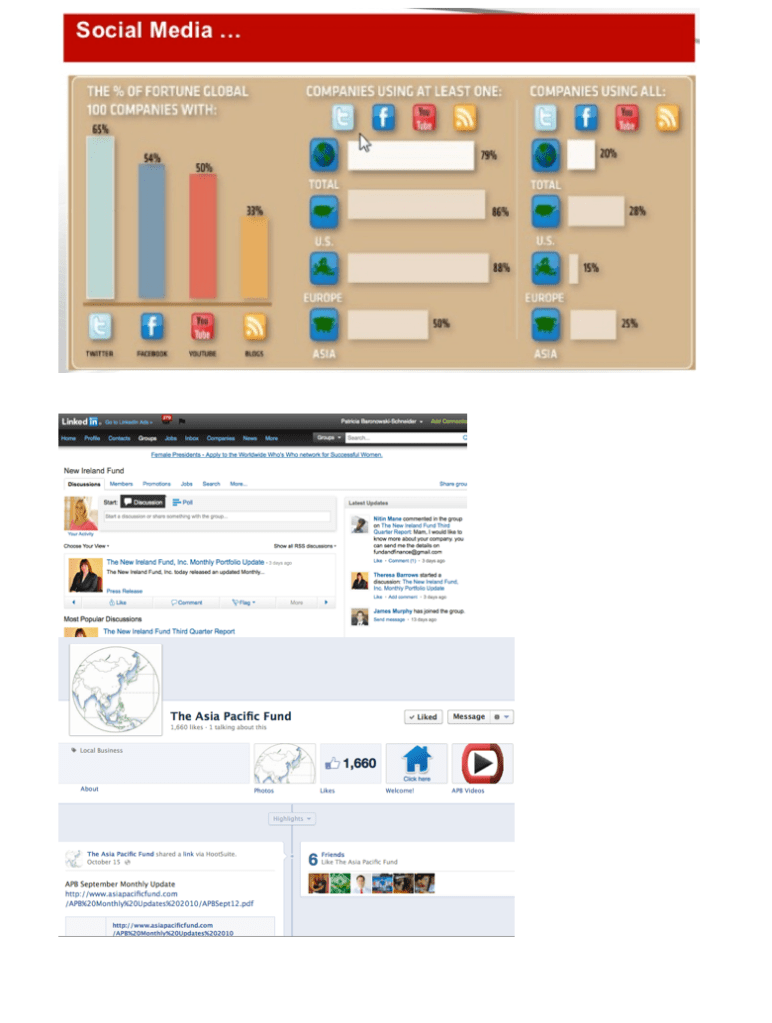

Social Media Marketing

Case Study

Case Study: Elevating Market Perception and Competitive Intelligence for XYZ Corporation

Case Study: Stock Market Positioning Study: Unveiling a Stock’s Place in

the Market Landscape

Case Study: Business and Stock Perception Studies

Case Study: Investor Activism Analysis: Examining the Impact of Engaged

Shareholders

Case Study: Broker Estimate Analysis: Decoding Analyst Expectations

Case Study: Peer Benchmarking

Case Study: Elevating Market Perception and Competitive Intelligence for XYZ Corporation

Case Study- Transformative Marketing and Digital Strategy for Financial Services Clients

Case Study- Comprehensive Marketing and PR Strategy Overhaul for Financial Clients

ABC FUND

Case Study- Growing Your Investor Base

Raising Capital

Raising Capital Through Strategic Alignment and Operational Efficiency

Challenge

Although the company had a sophisticated product with broad appeal in an expanding market, they were struggling to achieve lift off. Burn rate was unsustainable, while a first-time team lacked the experience to see through an investment strategy. For Orchid Black, the most immediate objective was to position the company to raise funds through an end-to-end investment strategy.

The Solution

At the outset, Orchid Black put together a thorough investment strategy, including:

- Due diligence preparation. A complete, investor-ready data room was prepared, including pitch materials. This often-overlooked aspect of investment preparedness was critical to the success of a quick fundraising cycle. The company was able to demonstrate sophistication and instill a sense of “deal FOMO” in investors.

- An investor pipeline and outreach plan. A highly targeted investor pipeline and multi-channel outreach plan was established for the company, leading to productive meetings, driving investor interest in the company. The pipeline provided the systematic, data-driven framework required to put the company in front of the right investors and align presentations with investor interests.

- Investor specific coaching for company leadership. While a pipeline was an essential framework for generating interest, it was also critical to establish a meeting strategy targeted to each investor. Orchid Black operators coached the founders in preparation for investor meetings by gathering critical intel, establishing a specific strategy for each meeting, and advising on how to drive the conversation forward.

“Orchid Black was able to help us through every step of the investment process,” said the company CEO, “providing a systematic and data-driven approach to secure funding.”

The Outcome

- A data driven roadmap to deliver strategic growth

- Client raised $2.25mm in under 6 months.

The end-to-end roadmap and execution Orchid Black provided achieved the desired objectives for the client, helping the pre-revenue startup hit their next growth milestone through successful investment strategy and execution.

**********************************************************************************************************

Case Study

Fund Raise

End to End Support for Fund Raise

Summary

Thread makes it easy for men to dress well by recommending the perfect clothes for each person. They combine expert stylists with powerful AI to simplify shopping.

The company was growing quickly with over 1 million users and looking to leverage their network by turning their customers into investors.

Springboarding on the back of their $22m Series B investment from H&M and Balderton, the team asked Raising Partners to work with them on securing investment for the remainder of the round, crowdfunding readiness and management.

Overall 31 days, we raised 2,025,340 from 3.129 Investors for Thread against on initial target of 500,000

Raised: 2,025,340

Investors: 3,129

Target: 500,000

Action:

Investor Readiness

Crowdfunding Management

Investor Introductions

I provided end-to-end support for the entire fundraise from introducing new investors to the opportunity, to the bespoke curation of the all-important crowdfunding – specific assets, namely the campaign video, investor desk, investor testimonials, pitch page and investor communications.,

I also acted as an ongoing strategic advisor between the platform and the team to ensure the smooth handling of all investment-related processes; E.G. legal documentation, due diligence and completions.

This was the first time the ‘crowd’ could invest on the same financial terms as professional investors, including H&M & Beringea.

OUTCOME: Nominated for Campaign of the Year

**********************************************************************************************************